A fast, alternative form of lending

Invoice lending, sometimes called invoice financing or invoice discounting, is an alternative to a small business loan. Businesses borrow money using sent invoices — those yet to be paid by customers or clients — as security.

Invoice Hub is a marketplace for invoice lending. People in business can browse and choose loan offers to free up cash flow while waiting for invoices to be paid. Lenders save time and marketing effort by connecting with new customers through our hub.

Fast, simple, easy

Join Invoice Hub

To browse competitive loan offers from leading lenders, upload your balance sheet and profit and loss statement for the last six months. Only approved lenders can see this information, and only if you upload an invoice. To keep using Invoice Hub, your balance and profit and loss documents must be updated every six months. Invoice Hub also runs an anti-money laundering check as part of your sign up process.

Add an invoice

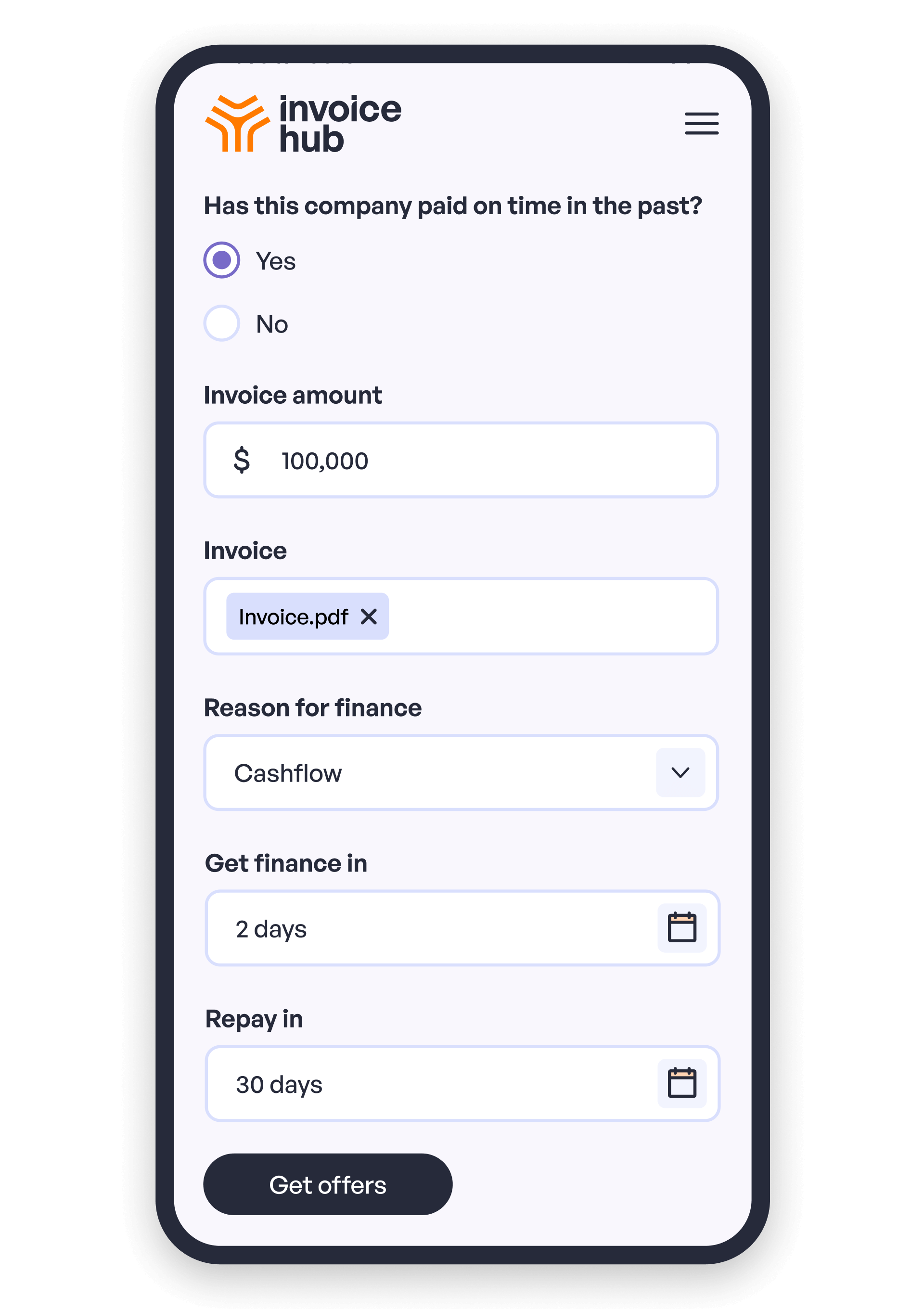

Upload an invoice you’ve sent to a customer or client. Any invoice of $5,000 or more can be uploaded. We’ll ask how long you have been doing business with the customer, and whether they paid you on time in the past. Invoice Hub never contacts your customers, even if they are late to pay you. Only approved lenders can view your invoices, and invoices can’t be viewed by any lenders once you select an offer. It’s free to upload invoices and browse loans.

Browse indicative loan offers

Look through loan offers from our partner lenders for free. Offers usually come within two days from when you enter your invoice. You’ll be able to see the amount offered, interest rate, turnaround time, and when payment is due for each offer.

Choose the right loan for you

When you choose an offer, the lender will contact you to agree on the terms and complete a few financial checks. Only approved lenders can offer through Invoice Hub. Once you select an offer, your invoice can no longer be seen by other lenders.

Receive payment

Depending on the turnaround time in the lender’s indicative offer, you will likely be paid within 24 to 48 hours from when you choose an offer.

Pay back your loan

The amount paid to your lender will include Invoice Hub’s fee of 1% of the loan amount. This gets added to your loan. Because the Invoice Hub platform is a marketplace, not a lender, we will never ask you for payment of any kind.

Got a question? We’re here to help

If you have a question we haven’t answered here, get in touch and let us know.